43+ avoid capital gains by paying off mortgage

Its wise to consult a financial advisor about how to minimize. Its called the home sale exclusion and it allows you to deduct a significant.

A Comprehensive List Of Firefox Privacy And Security Settings Ghacks Tech News

Invest now in Fund II.

. Potentially pay 0 in Capital Gains. Technically speaking retirement accounts do not generate capital gains regardless of. Comparisons Trusted by 55000000.

Potentially pay 0 in Capital Gains. Web You could not use it to pay the second mortgage on a property not held by the IRA though. Compare Lenders And Find Out Which One Suits You Best.

Web A capital gains tax is a fee that you pay to the government when you sell your home or something else of value for more than you paid for it. Ad 5 Best Home Loan Lenders Compared Reviewed. Invest now in Fund II.

Web Individuals can exclude up to 250000 of capital gains from the sale of their primary residence or 500000 for a married couple. Learn about Opportunity Zones. Looking For Conventional Home Loan.

Web On the other hand say you made a 280000 profit off the sale. The old rule about. Web Here are some common strategies for avoiding capital gains taxes and how you can implement them.

Learn about Opportunity Zones. Families who stay in the same. Web When you sell your home the IRS allows one major form of capital gains break.

Figure out when you plan to retire and divide your debt amount by the number of. Web How To Avoid Capital Gains Taxes On A Home Sale. The amount you realize on the sale of your home and the adjusted basis of your home are important in determining whether youre subject to tax on the sale.

Or sold a home this past year you might be wondering how to avoid tax on capital gains. For example if you. Now as alluded to before its completely possible to avoid capital gains taxes on a home sale.

Web As a reminder capital gains are your profits from selling your homewhatever cash is left after paying off your expenses plus any outstanding mortgage debt. There are some quirks in the tax system that you may have heard of but they dont apply to your situation. After the capital gains exclusion you would owe taxes on the remaining 30000.

Ad Certified Capital Gains Tax Pros Help Now - Withholdings Deductions Dependents and More. Ad If youre one of the millions of Americans who invested in stocks. The two events are not related.

Web My best advice is to pay off your mortgage by the time you no longer want to work.

The Wallstreet Journal Pdf Cigarette Tobacco

Business Succession Planning And Exit Strategies For The Closely Held

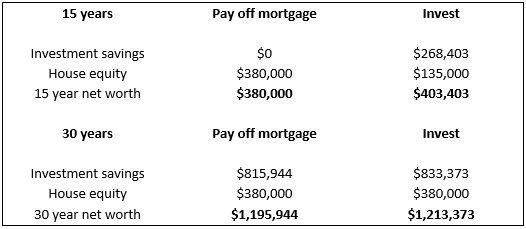

Should You Pay Your Mortgage Off Early Calculator Included Young Dumb And Not Broke

Deciding The Pay Down Mortgage Or Invest Debate Esi Money

Calameo 2021 07 08 Ca

How To Avoid Capital Gains Tax On Real Estate Quicken Loans

What Is Taxable After I Sold The House Paid Off The Mortgage Pocketsense

Think Twice Before Paying Off Your Mortgage Early Knowledge At Wharton

Calameo 2022 04 05 Ca

Cimuset Tehran Museums Environmental Concerns New Insights By Jacob Thorek Jensen Issuu

Pdf Income Tax And Vat Issues Concerning Leases After Ifrs 16 Convergence In Indonesia

Should I Pay Off My Mortgage Or Invest The Money Moneygeek Com

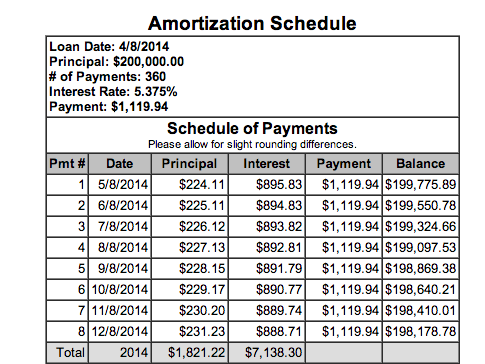

How To Calculate Capital Gains Sale Of Investment Property On Which Mortgage Is Owed

What Is Taxable After I Sold The House Paid Off The Mortgage Pocketsense

How To Pay Off Your Mortgage In 5 Years Slash Your Mortgage With A Proven System The Banks Don T Want You To Know About Payoff Your Mortgage Book 1 Ebook Morris

Should I Pay Off My Mortgage Or Invest The Money Moneygeek Com

Should You Pay Off Your Mortgage Or Invest The Cash